Social security taken out of paycheck

Why is FICA taken out of my check. Perfect answer Most people make less than 142800 per year so they pay the 62 percent payroll tax on every paycheck in.

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

The maximum amount of Social Security tax an employee will have withheld from their paycheck in.

. The Social Security tax rate is 124 percent. Should Social Security be taken out of my paycheck. Youre exempt from FICA taxes if youre a student at the school that you work for or if youre a nonresident alien with a specific type of visa such as F-1 J-1 M-1 or Q-1 visas.

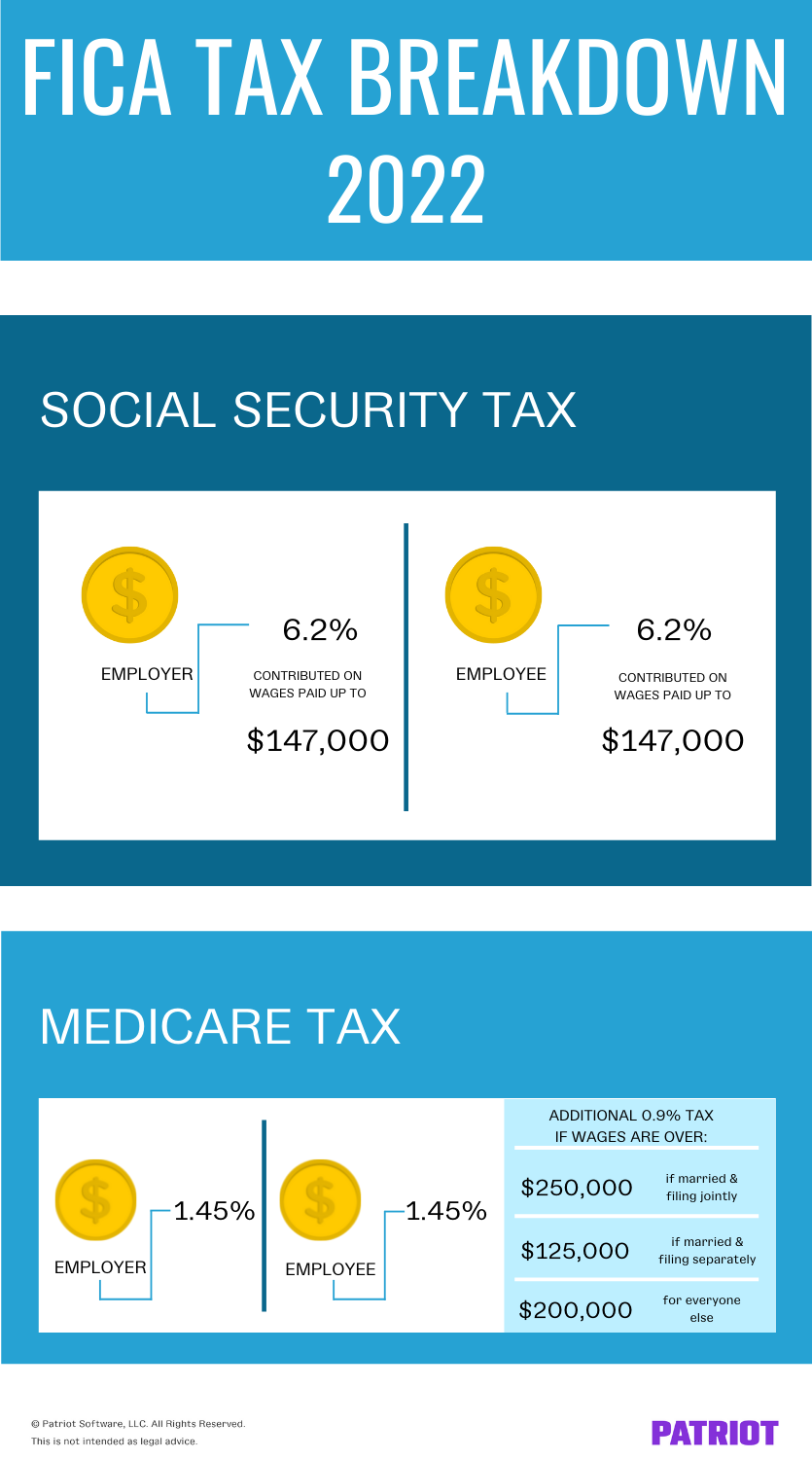

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The IRS and other states had. To calculate your total FICA hit each pay period or annually multiply your gross income by the.

No Medicare or Social Security Tax taken out of one employees check I am using Quickbooks Desktop Payroll and I have one employee whos paycheck didnt have any. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Your employer withholds Social Security tax from your paychecks at 42 percent for tax year 2011 of your gross income up to the yearly wage limit of 106800.

If you pay self-employment tax because of your employment classification you can deduct the employer portion of the tax -- 62 percent for Social Security and 145 percent for Medicare in. Most people are not aware that Social Security contributions are capped at the first 147000 of wage income. That means that someone who earns 1000000 per year stops paying into the.

Reason 1 The employee didnt make enough money for income taxes to be withheld. An employee who regularly makes 2000 per. Your two required FICA deductions in 2020 equal 765 percent of your gross wages.

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act of 1935. This withholding is 13020 more than the. In 2020 employers and employees will each pay 62 of wages up to 137700.

What is the percentage that is taken out of a paycheck. However when double withholdings are taken out beginning in January youll be paying twice as much in Social Security tax. Why are no federal taxes taken out of paycheck 2020.

Withholding refers to the money that your employer is. There are several reasons social security tax was not withheld from your paycheck. Your income is taxed at a steady rate up to the Social.

But if youre a high earner you might not pay Social Security taxes on your. If youre working in the United States youll see Social Security and Medicare tax withheld from your regular paychecks. Generally 62 of your income is taken out for Social Security taxes and 145 is taken out for Medicare taxes.

As of 2021 your wages up to 142800 147000 for 2022 are taxed at 62 for Social Security and your wages with no limit are taxed at 145 for Medicare. Deductions shows any additional deductions that might be taken out of your paycheck after tax like group life or disability insurance. For employee income 62 percent of the tax is paid by your employer and 62 percent is withheld from your paycheck.

What percentage of my paycheck is withheld for federal tax. You are a degree-seeking student in good standing attending school at least 12 time and you. ABC withholds 4340 in social security taxes 70000 620 and XYZ withholds 4030 65000 620 for a total 8370 withheld.

When Does Social Security Tax Stop Being Withheld. There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that fund the Social. In 2022 the Social Security tax limit is 147000 up from 142800 in 2021.

If you make the maximum taxable amount you will have 8537 deducted from your earnings.

What Happens When Employer Doesn T Withhold Social Security From Your Pay Sapling

10 Best Free Printable Blank Paycheck Stubs Paycheck Payroll Template Western Union Money Transfer

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

What Is Social Security Tax Calculations Reporting More

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pin On Social Security Disability Law

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Independent Contractor Debt Relief

Understanding Your W 2 Controller S Office

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

30 Financial Literacy Lesson Plans For Every Grade Level Financial Literacy Lessons Financial Literacy Consumer Math

What Is Social Security Tax Calculations Reporting More

Is There A Way To Print A Social Security Number On The Pay Stub

Paycheck Taxes Federal State Local Withholding H R Block